Aster Introduces Shield Mode: A Protected High-Performance Transaction Mode for On-Chain Traders

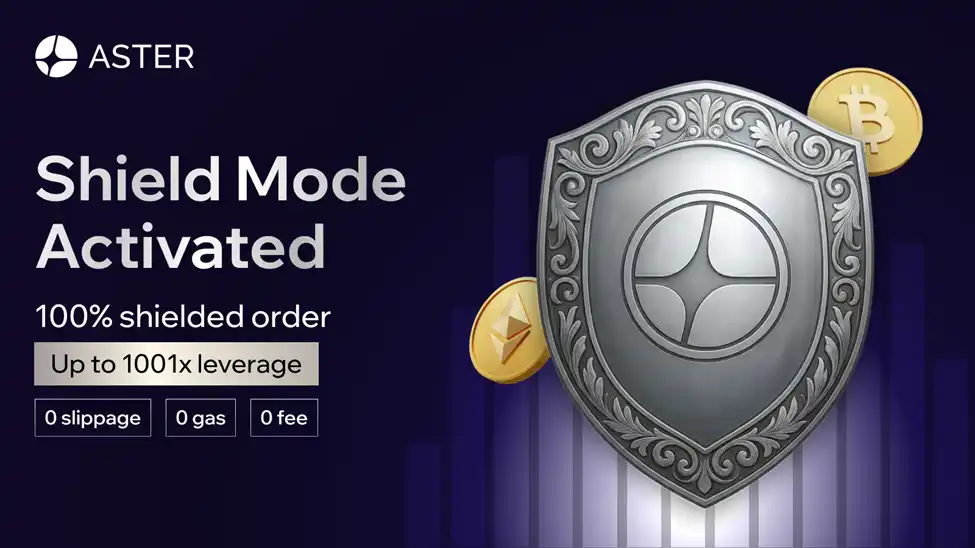

On December 15, 2025, Aster, a high-performance, privacy-focused on-chain trading platform supported by YZi Labs, today announced the official launch of Shield Mode. This new protected transaction mode has been directly integrated into Aster Perpetual, unleashing a high leverage trading experience of up to 1001x in a faster, more secure, and more flexible on-chain environment.

Shield Mode is a significant milestone in Aster's creation of the next-generation on-chain trading platform, aiming to serve professional and advanced traders while addressing the challenges of a fully transparent on-chain market.

Aster CEO Leonard stated: "Shield Mode embodies our vision of the future of on-chain trading—it is not just about leverage or speed, but also about control, privacy, and protection. We are building a trading platform that allows traders to operate at the highest level without disclosing their strategies to the market."

Evolution of On-Chain Trading: From 1001x to Shield Mode

Aster's 1001x product is renowned for continuously pushing the boundaries of on-chain perpetual trading, offering up to 1001x leverage, zero slippage, zero funding fees, and full on-chain settlement. As on-chain trading infrastructure has matured, traders have become increasingly aware of the cost of being "fully transparent"—especially the risk of exposing trading strategies and intents to the market.

In mid-2025, Aster introduced Hidden Orders in Aster Perpetual, allowing traders to participate in trading without disclosing prices and quantities while maintaining access to deep liquidity. This step brought greater privacy and strategy protection to on-chain trading.

Building on this foundation, Shield Mode has further evolved into a more comprehensive protected trading mode, combining high leverage performance with stronger trade intent protection, a smoother, more controlled trading experience.

Shield Mode: Aster's New Transaction Mode

Shield Mode is a brand-new transaction mode built directly on Aster Perpetual, integrating the full 1001x trading experience into a unified interface and account system.

This mode significantly simplifies the opening and management process of long and short positions by eliminating the need to interact with a public order book. Additionally, traders can seamlessly engage in high-leverage trading without cross-chain switches, avoiding fragmented operations and the need for frequent on-chain signatures.

The core advantages of the Aster 1001x trading model remain, including up to 1001x leverage for BTC and ETH, zero slippage, and zero opening fees. Furthermore, Shield Mode enhances efficiency by eliminating liquidation fees, completely waiving Gas costs, and achieving faster transaction execution. These improvements collectively set a new benchmark for on-chain perpetual trading in terms of cost efficiency and performance.

Flexible Fees to Match Different Trading Styles

Shield Mode adopts a flexible fee design, allowing traders to choose their payment method based on their own strategies and preferences.

In future updates, traders will be able to switch between two modes:

Commission Mode: Charges a transparent, fixed-rate transaction fee per trade, suitable for high-frequency and stable trading;

PnL Mode: Charges fees only when profitable, aligning better with performance-oriented trading strategies.

To celebrate the launch of Shield Mode, all fees for Shield Mode will be waived for the year. This upcoming flexible mechanism aims to empower traders to better control trading costs, allowing different trading styles to operate under a fee structure that better matches their risk profile and behavioral traits.

Laying the Foundation for the Next Stage of Aster

Shield Mode is not just a single feature upgrade but part of a grander vision for Aster. By introducing a protected transaction mode to the on-chain market, Aster provides traders with greater privacy and stronger strategy protection.

This article is contributed content and does not represent the views of BlockBeats.

You may also like

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…

White House Continues to Negotiate Over Crypto Market Structure Bill

Key Takeaways The White House is pushing for a compromise on the contentious issue of stablecoin yields in…

Billionaire Michael Saylor’s Strategy Acquires $75M More Bitcoin – Is This a Bullish Sign?

Key Takeaways Michael Saylor’s Strategy has expanded its Bitcoin holdings by purchasing an additional 855 BTC for $75.3…

Polymarket Bettors Assign Over 70% Probability of Bitcoin Dropping Below $65K — Are They Correct?

Key Takeaways Polymarket users predict Bitcoin has a 71% chance of falling below $65,000 in 2026, reflecting market…

CFTC Regulatory Shift Could Unlock New Growth for Coinbase Prediction Markets

Key Takeaways Newly appointed CFTC Chair, Michael Selig, aims for a unified federal oversight approach for crypto-linked prediction…

We Hacked Perplexity AI to Predict the Price of XRP, Bitcoin, and Ethereum By the End of 2026

Key Takeaways Perplexity AI predicts XRP may soar to $8 by 2026, fueled by legal victories and supportive…

Current Crypto Price Predictions: An In-Depth Analysis of XRP, Dogecoin, and Shiba Inu

Key Takeaways XRP, Dogecoin, and Shiba Inu are experiencing significant price declines amid geopolitical uncertainties and general market…

Pepe Coin Forecast: Price Appears Dismal, Yet Savvy Investors Rally Behind the Scenes

Key Takeaways Pepe Coin has experienced significant price drops, yet indicators suggest it may soon bottom out, with…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies has reported significant crypto holdings valued at $10.7 billion. The company’s Ethereum holdings…

Crypto Exchanges’ Stock Plunge 60% as Trading Volumes Dwindle – Is the Decline Ending or Just Beginning?

Key Takeaways Trading volumes on major crypto exchanges have drastically fallen, with a nearly 90% drop from October…

Best Crypto to Acquire Now February 2 – XRP, Solana, Ethereum

Key Takeaways Recent market turmoil saw Bitcoin plunge dramatically, affecting all major cryptocurrencies. XRP, Solana, and Ethereum are…

Ethereum Price Prediction: Top ETH Bulls Face $7.6 Billion in Paper Losses as Price Drops Below $2,400

Key Takeaways Ethereum has faced a downturn, dropping 19% below $2,400, resulting in significant paper losses for major…

Shiba Inu Price Prediction: SHIB Just Crashed to a 3-Year Low – Is SHIB Heading Towards Zero?

Key Takeaways Shiba Inu has recently hit a significant low, experiencing a 15% drop that places it at…

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…